The dream of owning a vacation rental property that generates consistent passive income has captivated many aspiring real estate investors. The allure of high rental rates, tax advantages, and potential for appreciation make vacation rentals an attractive investment option. However, the reality is more complex, with challenges that require careful planning and a realistic understanding of the market.

A recent study found that 35% of vacation rental owners experience a negative cash flow in their first year, underscoring the need for thorough research and strategic management. This comprehensive guide will explore the key benefits, critical considerations, and practical steps to determine if vacation rentals are a good investment for beginners.

Are Vacation Rentals a Good Investment? Exploring the Allure of Vacation Rental Investments

When considering whether vacation rentals are a worthwhile investment, several compelling factors make them an attractive option for many investors.

Unlock Higher Rental Income Potential

One of the primary draws of vacation rentals is the opportunity for substantially higher rental income compared to traditional long-term leases. Vacation properties can command significantly higher nightly rates, particularly in popular tourist destinations. For instance, a vacation rental in a sought-after beach town could earn between $200 and $300 per night, while a long-term lease in the same area might only yield around $1,500 monthly. This significant difference in rental income can lead to impressive cash flow, especially during peak tourist seasons.

Capitalize on Tax Advantages

Investing in vacation rentals also offers a range of tax benefits that can enhance an investor’s overall profitability. Expenses such as mortgage interest, property taxes, maintenance, and even depreciation can be deducted from taxable income. This ability to offset rental income with deductible expenses can result in substantial tax savings, making vacation rentals an even more appealing investment option.

Benefit from Potential Appreciation

Real estate in desirable vacation areas tends to appreciate over time, which can contribute to long-term wealth building. As property values increase, so does the equity in your investment. This potential for appreciation not only enhances your financial security but also provides the opportunity for a profitable exit strategy if you decide to sell your vacation rental in the future. For example, a property in a growing tourist area could see its value rise significantly over several years.

Enjoy Flexibility and Control

Owning a vacation rental offers a unique blend of income generation and personal enjoyment. As the property owner, you have the flexibility to set your own rental rates, manage your booking schedule, and even use the property for your own vacations when it’s not occupied by guests. This dual-purpose can be particularly advantageous for investors who value both financial returns and the ability to enjoy the property themselves.

Key Considerations Before Investing

While the potential benefits of vacation rentals are compelling, it’s essential to carefully consider several critical factors before deciding if this investment strategy is right for you.

Conduct Thorough Market Research

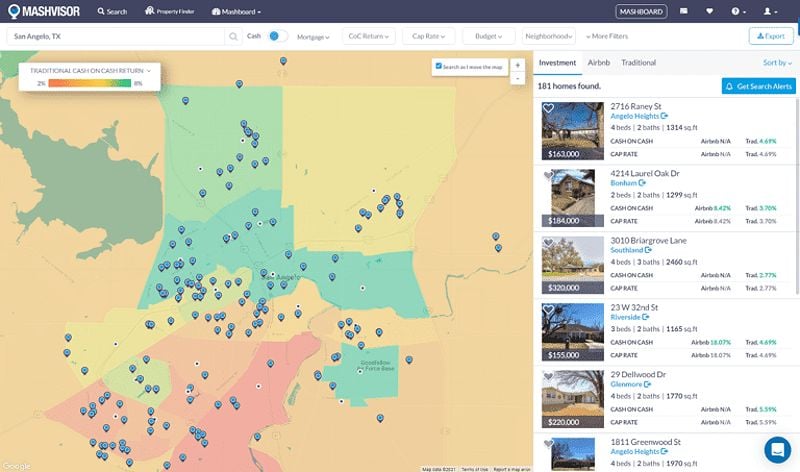

Identifying profitable vacation rental destinations requires in-depth market research. Understanding local tourism trends, seasonal demand patterns, and property availability can provide valuable insights into the viability of a specific market.

Analyze Popular Tourist Destinations

Focus your research on high-demand areas with consistent visitor traffic and appealing attractions that draw tourists year-round. This can help you identify markets with strong rental potential.

Assess Seasonal Demand Fluctuations

Evaluate how rental demand fluctuates throughout the year in your target market. Understanding peak and off-peak seasons will enable you to predict potential rental income and plan for periods of lower occupancy.

Investigate Property Availability and Competition

Analyze the availability of rental properties in your target market and evaluate the level of competition. A saturated market may require more strategic marketing efforts to differentiate your property and attract guests.

Familiarize Yourself with Local Regulations

Many municipalities have specific laws governing short-term rentals, including licensing requirements, zoning restrictions, and occupancy limits. Familiarizing yourself with these regulations is crucial to ensure you can operate your vacation rental legally and avoid potential fines or penalties.

Consider Seasonality and Demand Patterns

The income generated by vacation rentals can vary significantly based on the time of year. Understanding demand patterns in your target market is essential for accurate financial planning and managing your property’s profitability.

Identify Peak and Off-Peak Seasons

Determine the peak and off-peak seasons in your market, as this will impact your rental rates and occupancy levels. Devising strategies to attract guests during slower periods can help mitigate the impact of fluctuating demand.

Anticipate Demand Fluctuations

Analyze how demand may be affected by factors such as holidays, local events, and weather conditions. This knowledge can help you optimize your pricing and marketing efforts to capitalize on periods of high demand.

Budget Carefully for Operational Expenses

Accurately forecasting and budgeting for operational expenses is critical to maintaining profitability. These costs can include property management fees, maintenance, insurance, utilities, cleaning, and marketing.

Understand Property Management Costs

Decide whether you will self-manage your property or hire a professional property manager, and factor in their associated fees. This will impact your overall operational expenses.

Plan for Maintenance and Repairs

Allocate funds for regular maintenance, repairs, and potential upgrades to keep your property in top condition and ensure a positive guest experience.

Account for Additional Expenses

Don’t forget to budget for insurance, utilities, cleaning services, and marketing efforts to attract and retain guests.

Prepare for Potential Vacancy Periods

Be mindful of the risk of vacancy, especially during off-peak seasons or in highly competitive markets. Implement strategies to reduce vacancy, such as offering discounts or promotions, optimizing your pricing, and intensifying your marketing efforts.

Differentiate Yourself in a Competitive Market

The vacation rental market is becoming increasingly crowded, requiring effective marketing strategies and a commitment to maintaining high property standards. Identify unique selling points, utilize professional photography and optimized listings, and focus on providing an exceptional guest experience to stand out from the competition.

Finding the Right Vacation Rental Property

Identifying a suitable vacation rental property involves leveraging various strategies and resources.

Explore Online Marketplaces

Platforms like Roofstock, Evolve, and Vacasa allow you to browse, compare, and analyze potential vacation rental investments. These specialized marketplaces can provide valuable insights into market data, rental income estimates, and property availability.

Utilize Traditional Listing Services

In addition to vacation rental-specific platforms, traditional real estate listing services like Zillow and Realtor.com can offer insights into market trends and provide access to properties that may not be listed on dedicated vacation rental platforms.

Tap into Your Network

Connecting with other investors, real estate agents, and property managers can help you uncover off-market deals and gain valuable insights into local markets. Participating in real estate investor groups, building relationships with agents, and networking with experienced property managers can be invaluable in your search for the right vacation rental property.

Identify Profitable Property Characteristics

When evaluating potential vacation rental investments, focus on the following factors:

- Location: Target high-demand areas with strong tourism and rental income potential.

- Property Condition: Choose well-maintained properties with desirable amenities that appeal to vacation renters.

- Rental Income Potential: Carefully analyze rental income data and market trends to estimate the property’s earning capacity.

Managing Your Vacation Rental Property

Successful management of a vacation rental requires a comprehensive approach, from marketing and guest communication to financial oversight and property maintenance.

Decide on a Management Strategy

You have several options when it comes to managing your vacation rental:

Self-Management

Handle bookings, guest communication, and property maintenance yourself. This can be cost-effective but requires a significant time commitment.

Professional Property Management

Hire a professional property manager to oversee day-to-day operations, including marketing, bookings, and guest services. This can alleviate the burden but comes with associated fees.

Vacation Rental Management Company

Partner with a management company that handles all aspects of operating your property, allowing you to focus on other investment opportunities.

Develop an Effective Marketing Plan

Utilize a multi-pronged marketing approach to reach potential guests and maximize occupancy:

Online Platforms

List your property on popular booking sites like Airbnb and VRBO to tap into a broader audience.

Dedicated Website

Create a professional website to showcase your vacation rental’s unique features and amenities.

Local Outreach

Engage in targeted local marketing efforts to attract guests in your target area.

Prioritize Guest Communication and Services

Provide exceptional customer service to enhance the guest experience and encourage repeat bookings:

Prompt Responses

Respond quickly to guest inquiries and maintain clear communication throughout their stay.

Excellent Customer Service

Go above and beyond to ensure your guests have a memorable and positive experience.

Thoughtful Amenities

Offer amenities that improve guest comfort, such as complimentary snacks, Wi-Fi, and local guides.

Maintain the Property Diligently

Prioritize regular maintenance and prompt repairs to keep your vacation rental in top condition:

Scheduled Maintenance

Implement a proactive maintenance plan to prevent larger issues and preserve the property’s condition.

Timely Repairs

Address any necessary repairs quickly to ensure a positive experience for your guests.

Manage Finances Meticulously

Maintain detailed financial records and implement strategies to optimize profitability:

Track Income and Expenses

Carefully document your rental income and operational costs to evaluate the investment’s performance.

Maximize Profitability

Utilize data-driven approaches to optimize rental rates, minimize expenses, and enhance overall profitability.

Calculating Your Return on Investment (ROI)

Evaluating the potential return on investment is a crucial step in determining the viability of a vacation rental investment. Several key metrics can provide valuable insights.

Cash-on-Cash Return

This metric measures the annual cash flow relative to the total cash invested, helping you assess whether your investment is generating adequate returns.

Rental Yield

Rental yield compares your rental income to the property’s value, providing insights into the overall profitability of your investment.

Other ROI Metrics

- Cap Rate: Measures the property’s potential return on investment based on its net operating income (NOI).

- Net Operating Income (NOI): Calculates the property’s income after deducting operating expenses, offering a clear picture of profitability.

Financing Your Vacation Rental Investment

Securing the right financing is a critical aspect of purchasing a vacation rental property. Explore various financing options to determine the most suitable approach for your investment goals and financial situation.

Conforming Loans

Traditional mortgages that meet specific guidelines set by Fannie Mae and Freddie Mac typically require a good credit score and a down payment of around 20%.

Portfolio Loans

These loans are designed for investors with multiple properties, often offering more flexible terms and lower down payment requirements.

Multifamily Loans

These loans can finance properties with two to four units, allowing investors to generate income from multiple rental units.

Short-Term Loans

Options like bridge loans and hard money loans provide quick access to financing but often come with higher interest rates, so they should be approached with caution.

Tips for Securing Financing

- Maintain a Strong Credit Score: Demonstrate your creditworthiness to qualify for favorable loan terms.

- Provide a Substantial Down Payment: Show your financial commitment by making a significant down payment.

- Present a Clear Investment Strategy: Clearly articulate your investment plan to lenders to improve your chances of securing financing.

Conclusion

Investing in vacation rentals can offer significant financial rewards, but it also comes with challenges that require careful consideration. By conducting thorough research, planning effectively, and managing your property efficiently, you can determine if vacation rentals are a good investment for your real estate portfolio.

Whether your goal is passive income, long-term wealth building, or a combination of both, the vacation rental market presents a compelling opportunity for aspiring real estate investors. With the right approach and a deep understanding of the market, you can unlock the potential of this investment strategy and achieve your financial objectives.