San Francisco, a hub of innovation and a magnet for high-earning tech professionals, offers a dynamic real estate market with the potential for significant appreciation. As a tech employee, navigating this competitive landscape, including buying homes in San Francisco, can be a rewarding endeavor, providing opportunities to diversify your investments and secure your financial future.

The Allure of Buying Homes in San Francisco for Tech Employees

The Booming Tech Scene and Its Impact on Housing Demand

The rapid expansion of the tech industry in San Francisco has dramatically influenced housing demand, leading to a surge in home prices. As tech companies continue to flourish and attract talent from around the globe, the influx of high-earning professionals has created a fiercely competitive real estate market.

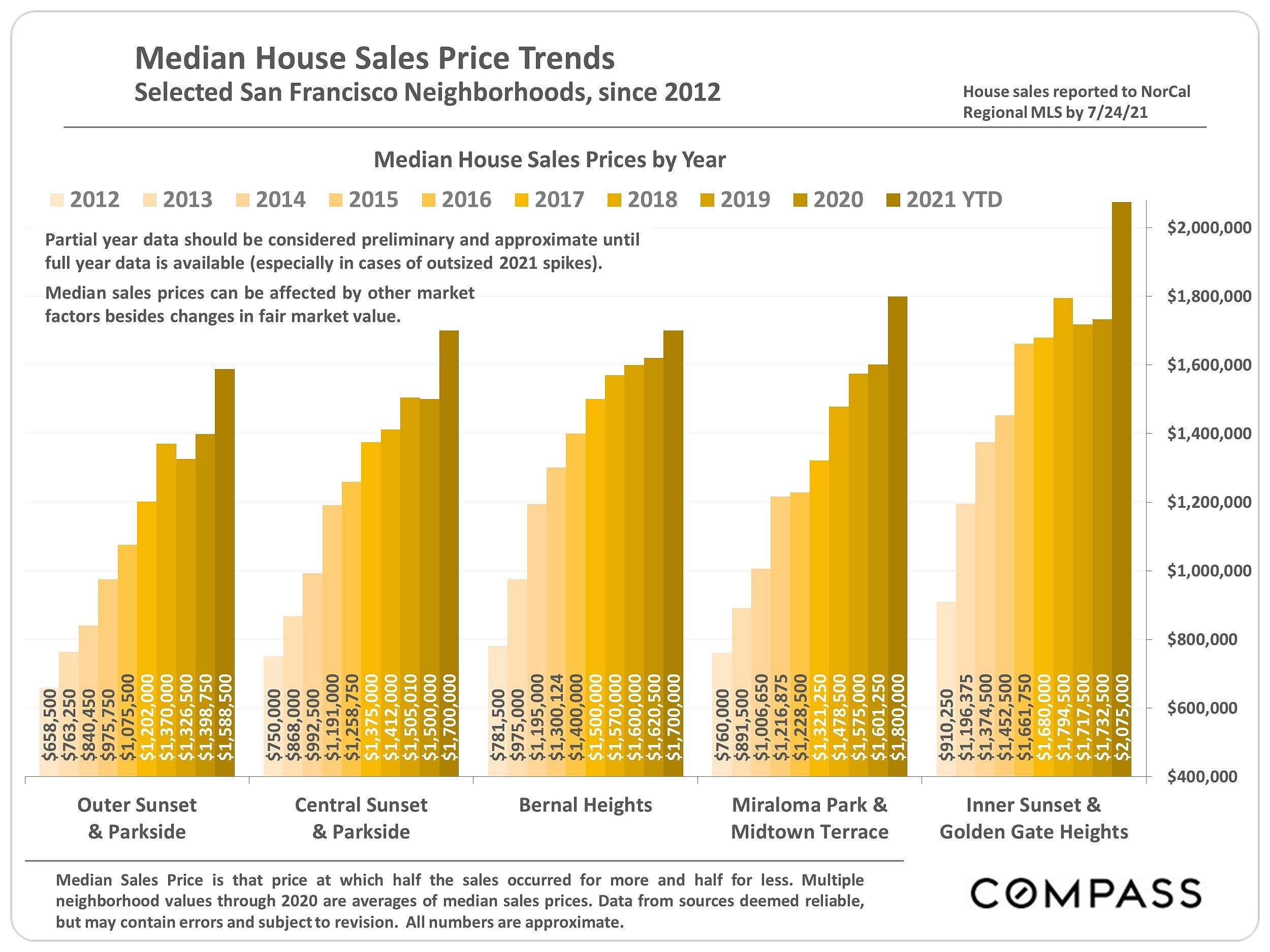

Recent data suggests that the average home price in San Francisco has skyrocketed, with some neighborhoods experiencing annual appreciation rates exceeding 10%. Areas near tech hubs like SoMa and the Mission District have witnessed particularly noteworthy price increases, reflecting the desirability of living in close proximity to workplaces. As the tech sector thrives, the demand for housing is expected to remain robust, making investing in San Francisco real estate a potentially lucrative endeavor.

Stability and Income Potential of Real Estate

Real estate is often regarded as a more stable investment compared to the volatility of the stock market. For tech employees holding substantial stock options, diversifying your portfolio to include real estate can provide a protective measure against market fluctuations. Owning property not only offers the potential for appreciation but also opens doors to generating passive income through rentals.

Many tech professionals have discovered that investing in rental properties can yield a reliable cash flow, especially in a city where rental demand remains consistently high. This financial stability is particularly appealing for those who may face income fluctuations due to the unpredictable nature of the tech industry. By buying homes in San Francisco, you can effectively build long-term wealth and create a balanced investment portfolio.

Diversification and Risk Mitigation

If your investment portfolio is heavily reliant on stock options, diversifying into real estate can be a strategic move. Real estate can act as a hedge against the volatility of the stock market, fostering a more balanced and secure investment approach. A diverse portfolio that includes both real estate and stock options can help mitigate risks and enhance your long-term financial stability.

Navigating the San Francisco Housing Market: Key Considerations

Understanding the Market Dynamics

Before embarking on your home-buying journey in San Francisco, it’s crucial to comprehend the current market dynamics. As of 2024, the housing market remains competitive, characterized by low inventory levels and fluctuating interest rates. Prospective buyers should be aware that homes in sought-after neighborhoods often attract multiple offers, leading to bidding wars.

Staying informed about the economic factors that influence the housing market is essential. Job growth in the tech sector, changes in interest rates, and the overall economic outlook can all impact home prices and availability. By grasping these dynamics, you can better position yourself when considering buying homes in San Francisco.

Identifying Neighborhoods with Potential

Selecting the right neighborhood is vital for maximizing your investment potential. As a tech employee, you should focus on areas that align with your lifestyle preferences while also showing signs of appreciation. Neighborhoods such as the Outer Sunset, West Portal, and Forest Hill have become increasingly popular due to their family-friendly atmospheres and proximity to parks and schools.

Researching neighborhood trends can yield insights into potential future appreciation. Examining upcoming developments, transportation improvements, and local amenities can help gauge a neighborhood’s growth potential. Utilize online resources and local real estate reports to stay updated on the best areas for investment.

Financing Options for Tech Employees

Understanding the various financing options available is a critical step in the home-buying process. Conventional mortgages, jumbo loans, and creative financing strategies are all viable options for tech employees. Given the high cost of homes in San Francisco, exploring different loan products and obtaining pre-approval can significantly enhance your ability to navigate the competitive landscape.

Collaborating with a mortgage broker can provide valuable insights into the best financing options tailored to your financial situation. They can clarify the differences between loan terms and assist in finding a lender that aligns with your specific needs. Being financially prepared can give you a competitive edge when making offers on homes.

Strategies for Finding the Right Home and Securing a Good Deal

Defining Your Needs and Priorities

As you embark on your home-buying journey in San Francisco, take the time to clearly define your needs and priorities. Factors such as home size, desired amenities, and proximity to work can significantly influence your decision-making process. Additionally, establishing a realistic budget is crucial to avoid overspending in a competitive market.

Understanding your personal lifestyle preferences can also guide your search. For instance, you may prioritize access to public transportation, or you might value outdoor spaces and community facilities. By identifying what is most important, you can streamline your home search and make more informed decisions.

Leveraging Your Tech Skills for Research

Your analytical skills as a tech employee can be beneficial when researching neighborhoods and properties. Utilizing online resources, data analysis techniques, and neighborhood forums can provide valuable insights into the housing market. By harnessing these skills, you can gather information about property values, neighborhood trends, and local amenities.

Conducting thorough due diligence is essential for making informed decisions. Analyzing market trends, evaluating comparable sales, and understanding local zoning laws can help you identify properties that align with your investment goals. This research phase is critical for ensuring you make sound investments in the competitive San Francisco market.

Negotiating the Best Deal

Negotiation is a vital aspect of the home-buying process. Approach negotiations with confidence and preparation. Being informed about market conditions and comparable sales can bolster your position during discussions with sellers.

Clear and assertive communication is crucial during negotiations. Leverage your analytical skills to evaluate offers and counteroffers effectively. Additionally, collaborating with an experienced real estate agent can provide valuable support in navigating the negotiation process and securing the best possible deal.

Essential Steps Before Closing

The Importance of Home Inspections

Conducting a thorough home inspection is a vital step in the buying process. It allows you to identify any potential issues that may require costly repairs after closing. Prioritize hiring a reputable home inspector who can provide a comprehensive evaluation of the property.

Understanding the inspection report and addressing any concerns with the seller can prevent future headaches. Negotiating repairs or credits based on the inspection findings can also lead to a better overall deal. Ensuring the home is in good condition before finalizing the purchase is essential for protecting your investment.

FAQ

Q: How much should I expect to pay for a home in San Francisco?

A: Home prices in San Francisco vary widely based on location, size, and condition, but you can expect prices to range from $1 million to over $3 million.

Q: What are the best neighborhoods for tech employees in San Francisco?

A: Popular neighborhoods for tech employees include SoMa, Mission District, and Outer Sunset, known for their proximity to tech hubs and vibrant community amenities.

Q: What challenges might I face when buying a home in San Francisco?

A: Challenges include high prices, limited inventory, and competitive bidding situations, which can make finding the right home more difficult.

Q: How can I ensure I’m getting a good deal on a home in San Francisco?

A: Thorough research, effective negotiation, and obtaining pre-approval for financing can help you secure a good deal.

Conclusion

In conclusion, buying homes in San Francisco presents a compelling opportunity for tech employees seeking to diversify their investments. By understanding the unique advantages of the city’s real estate market, navigating the key considerations, and implementing strategic home-buying approaches, you can make informed decisions and secure your financial future. Embrace the potential of San Francisco real estate and embark on your journey towards a rewarding investment.