Planning your wedding is an exciting, yet significant, financial commitment. You want to create a memorable celebration without breaking the bank. This guide will help you determine how much to spend on your wedding while staying within your budget and achieving your long-term financial goals.

Understanding the Average Wedding Cost

The idea of a lavish wedding with a hefty price tag is often romanticized, but the reality is that 70% of couples face significant financial pressure when planning their wedding. Comprehending the true cost of a wedding and setting a realistic budget are crucial steps in avoiding financial strain.

In 2024, the average wedding cost in the United States hovers around $30,000. However, this figure can vary greatly based on factors like location, guest count, and vendor choices. For instance, 60% of couples choose to spend less than the national average, highlighting the importance of creating a budget that aligns with your individual financial realities.

Factors Influencing Wedding Costs

While the average cost provides a general benchmark, it’s important to remember that wedding expenses can fluctuate significantly depending on your specific choices. For example, a couple opting for a destination wedding in a popular tourist location will likely face higher costs than those choosing a local ceremony and reception. Additionally, the season can play a role, as peak wedding season (spring and fall) often sees higher prices due to increased demand. Consider researching local wedding vendor pricing and comparing costs for different services to get a realistic idea of the expenses in your area.

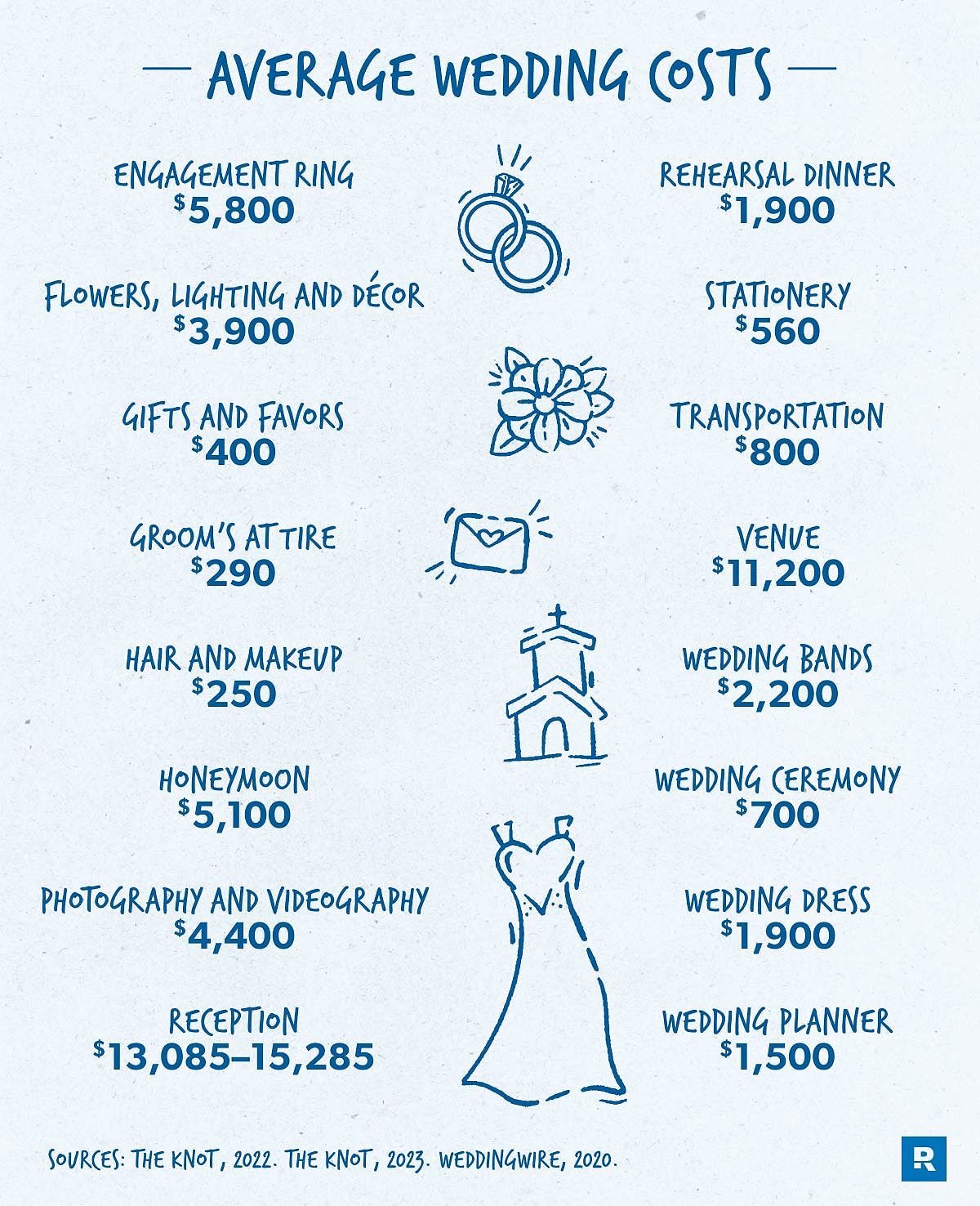

Breaking Down Typical Wedding Expenses

It’s crucial to remember that these figures are averages and can vary greatly based on individual preferences, location, and the overall scale of the wedding. For instance, a couple choosing a smaller, more intimate wedding with a limited guest list might significantly reduce their venue and catering costs. Additionally, couples opting for a DIY approach to decorations or entertainment can also save on these expenses. Consider using online tools and calculators to estimate your wedding expenses based on your specific choices and preferences.

| Expense Category | Average Cost |

|---|---|

| Venue | $11,200 |

| Catering | $8,775 |

| Photography | $2,500 |

| Wedding Attire | $3,000 |

| Flowers and Décor | $2,500 |

| Entertainment | $2,000 |

| Wedding Planner | $1,500 |

| Miscellaneous | $2,000 |

Crafting a Realistic Wedding Budget

While budgeting tools and apps can be helpful, it’s essential to factor in unexpected costs, such as last-minute changes or unforeseen circumstances. A good rule of thumb is to allocate a contingency fund of 10-15% of your total budget to cover these potential expenses. Consider discussing your budget with your fiancé(e) and families to determine potential contributions or shared responsibilities.

Remember, your wedding budget should reflect your financial priorities and goals. It’s important to align your wedding expenses with your overall financial plan, ensuring you don’t compromise your long-term financial stability.

Prioritizing Expenses

This shift towards prioritizing experiences over material possessions is evident in the increasing popularity of “elopements” and “micro-weddings,” where couples focus on intimate ceremonies and personalized experiences rather than elaborate receptions. Consider creating a “wedding vision board” or a list of your top priorities to guide your budgeting decisions. This can help you allocate funds effectively and ensure your wedding reflects your unique style and values.

Remember, your wedding day is about celebrating your love and commitment. Focus on creating meaningful experiences and memories that will last a lifetime, rather than striving for a lavish display that might not align with your financial goals.

Saving Money on Common Wedding Expenses

Venue and Catering

Consider exploring alternative venues, such as historical buildings, museums, or outdoor gardens, which can offer unique settings at potentially lower costs. Additionally, consider hosting your wedding during the off-peak season or on a weekday, as venues often offer discounts during these times. For catering, consider offering a limited menu or opting for a buffet-style service, which can be more cost-effective than a plated dinner. Explore the option of a “cocktail reception” or a “light bites” menu instead of a full meal, which can significantly reduce catering costs.

Photography and Videography

Consider hiring a student photographer or videographer, who may offer lower rates while still providing quality services. Alternatively, consider using a “photo booth” or “guest book” with instant prints as a fun and interactive way to capture memories without the expense of full-time photography and videography. Remember, your wedding photos and videos should capture the essence of your special day and tell the story of your love. Focus on hiring professionals who align with your style and vision, and don’t be afraid to negotiate for affordable packages.

Wedding Attire

Consider browsing online retailers or consignment shops for affordable wedding dresses and suits, which can offer significant savings compared to traditional bridal boutiques. Alternatively, consider renting your wedding attire, which can be a cost-effective option for both the bride and groom. Remember, your wedding attire should reflect your personal style and make you feel confident and beautiful on your special day. Don’t feel pressured to spend a fortune on a dress or suit that doesn’t align with your budget or preferences.

Flowers and Décor

Consider using seasonal flowers, which are often more affordable than out-of-season blooms. Incorporate greenery, such as ferns, ivy, or eucalyptus, which can create a lush and natural aesthetic at a lower cost. Consider using DIY decorations or repurposing items from your home or family heirlooms to add a personal touch and reduce expenses. Remember, your wedding décor should complement your venue and create a cohesive and inviting atmosphere. Focus on creating a unique and meaningful ambiance without breaking the bank.

Financial Strategies for a Debt-Free Wedding

Consider setting up a separate savings account specifically for wedding expenses, which can help you track your progress and avoid using your emergency fund for wedding-related costs. Use a budgeting app or spreadsheet to track your income and expenses, ensuring you stay within your allocated budget.

Remember, a debt-free wedding requires discipline and planning. Don’t be afraid to say “no” to vendors or requests that don’t align with your budget or financial goals. Prioritize experiences and memories over material possessions. Focus on creating a meaningful and memorable celebration that reflects your love and commitment, rather than striving for a lavish display that might compromise your financial stability.

Frequently Asked Questions

How much should I spend on an engagement ring?

The cost of an engagement ring should be within your budget and reflect your financial situation. Don’t feel pressured to spend beyond your means to impress your fiancé(e) or others.

What are some tips for saving money on wedding flowers?

Use seasonal flowers, incorporate greenery, and consider DIY decorations to create a beautiful, cost-effective floral display.

Is hiring a wedding planner worth the cost?

Hiring a wedding planner can save you time and stress, but it can also be a significant expense. Consider your budget and priorities when deciding whether to hire a planner.

What should I consider when setting my wedding budget?

When setting your wedding budget, consider your financial goals and priorities as a couple. Ensure your wedding plans align with your long-term financial aspirations and don’t compromise your future financial stability.

How can I manage wedding expenses without feeling overwhelmed?

Use budgeting tools and apps to track your income and expenses, and allocate a contingency fund to cover unexpected costs. Regularly review your budget to ensure you stay on track.

Conclusion

Planning a debt-free wedding requires careful planning, prioritization, and a commitment to your financial goals. By embracing a thoughtful and strategic approach to wedding planning, you can create a memorable and meaningful celebration that reflects your love and commitment while safeguarding your financial future.

Remember, your wedding day is just the beginning of your journey together. Focus on creating a strong financial foundation that supports your future dreams and aspirations. With a realistic budget and a focus on what truly matters, you can have the wedding of your dreams without compromising your long-term financial stability.

Additionally, consider the rising trend of “micro-weddings” and “elopements,” which reflect a shift towards more intimate and personalized celebrations, often with a smaller guest list and a focus on meaningful experiences. Technology is also impacting wedding planning, with online tools and platforms offering couples more options for budgeting, vendor research, and guest management.

Some may argue that a wedding is a once-in-a-lifetime event that deserves a lavish display. However, it’s important to remember that a wedding is a starting point for a lifelong journey together, and financial stability is crucial for building a strong foundation for your future. By prioritizing experiences and memories over material possessions, you can create a celebration that aligns with your values and safeguards your financial future.

Ultimately, planning a debt-free wedding requires discipline, strategic thinking, and a commitment to your long-term financial goals. By embracing this approach, you can have the wedding of your dreams while maintaining a solid financial footing for the years to come. Remember, your love and commitment are the true foundations of your marriage, and with careful planning, you can celebrate this special day without compromising your financial future.