Net Worth To Retire At 60: A Guide For Young Adults

Planning for a comfortable retirement at 60 requires understanding the role of net worth. This guide helps young adults determine the right net worth to retire at 60, explore income sources, and implement strategies to build financial security.

Introduction

Imagine yourself at 60, free to pursue your passions, travel the world, or simply enjoy the fruits of your labor. But how much money do you need to make that dream a reality? The answer lies in your net worth, which plays a crucial role in achieving a comfortable retirement.

As a young adult, starting to plan for retirement early is essential. In this guide, we’ll explore the concept of net worth, understand your retirement income needs, and provide actionable steps to help you build the financial foundation necessary for a fulfilling retirement at 60.

Understanding Your Retirement Income Needs and Net Worth to Retire at 60

The 80% Rule (and Why It Might Not Be Enough)

A commonly cited rule of thumb suggests that retirees should aim to replace around 80% of their pre-retirement income. However, this percentage can vary depending on your individual circumstances. If you plan to downsize your living situation or have paid off your mortgage by the time you retire, your expenses may be lower, and you may be able to live comfortably on less than 80% of your previous income. Conversely, if you envision an active retirement filled with travel and hobbies, you may need to aim for a higher income replacement rate, such as 90% or even 100%.

The Importance of Healthcare Costs

As you age, medical expenses often increase, and it’s crucial to account for these in your retirement income calculations. According to the Kaiser Family Foundation, average annual out-of-pocket healthcare costs for people aged 65 and over are estimated to be around $5,000. This includes costs for premiums, deductibles, copayments, and medications. It’s essential to factor in these potential costs when determining your retirement income needs.

Using Retirement Calculators

Many online retirement calculators allow you to input your current income, expenses, savings, and desired retirement lifestyle to generate personalized estimates of your retirement income needs and net worth goals. By using these tools and considering your unique circumstances, you can determine the net worth you’ll need to achieve your desired standard of living in retirement.

Building Your Net Worth for Retirement

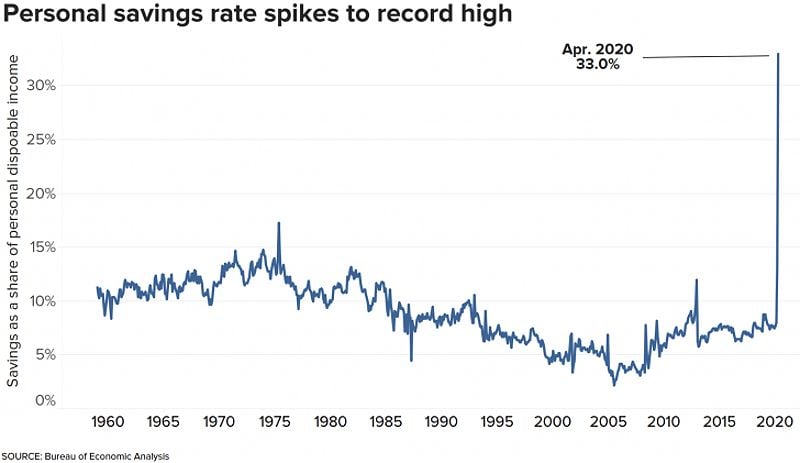

Start Saving Early and Often

The power of compound interest is your greatest ally when it comes to building your net worth for retirement. Even small contributions can accumulate significantly over time, so it’s crucial to start saving as early as possible. For example, if you save $5,000 per year starting at age 25, you could have over $1 million in your retirement account by age 60, assuming a 7% annual return.

Maximize Your Retirement Contributions

Contribute the maximum amount allowed to your retirement accounts, whether through employer-sponsored plans like 401(k)s or individual savings vehicles like Roth IRAs. Take advantage of employer matching programs, as this is essentially free money. Consider increasing your contribution rate gradually over time, even if it’s by just a small percentage each year.

Invest for Growth

Allocate a portion of your savings to a diversified investment portfolio, including stocks, bonds, and potentially real estate. Consider using a mix of index funds and exchange-traded funds (ETFs) to achieve broad market exposure with lower fees. Index funds track a specific market index, such as the S&P 500, while ETFs trade on stock exchanges like individual stocks.

Manage Your Debt

Prioritize paying down high-interest debt, such as credit cards and student loans. Debt can hinder your savings growth and impact your overall net worth. Create a budget and make debt repayment a top priority to free up more cash flow for savings and investments.

Beyond Savings: Other Income Sources

While your personal savings and investments will likely be the foundation of your retirement income, it’s essential to explore other sources as well.

Social Security Benefits

Estimate your future Social Security benefits based on your work history and earnings. The Social Security Administration offers a free online tool called ‘My Social Security’ that allows you to create an account and access your personalized benefit estimates. Regularly reviewing your statement can help you understand how your benefits are projected to change over time.

Pensions

If you’re fortunate to have a pension from a current or previous employer, factor this guaranteed income into your retirement calculations. Pensions can provide a stable income stream, reducing the pressure on your personal savings.

Part-Time Work

Many retirees find that part-time work can offer a sense of purpose, social interaction, and financial flexibility. It can also help bridge the gap between retirement income and expenses, especially during the early years of retirement.

Rental Income

Investing in real estate can generate passive income to support your retirement lifestyle. However, it’s essential to research the market and consider your financial capacity before investing in rental properties.

Adjusting Your Plan for Unexpected Events

No retirement plan is immune to unexpected events, so it’s important to have strategies in place to address potential challenges.

Health Issues

Maintain adequate health insurance coverage, including long-term care insurance, to protect your net worth. Long-term care insurance can help cover the costs of assisted living, nursing home care, or in-home care if you need assistance with activities of daily living.

Market Volatility

Diversify your portfolio, rebalance regularly, and consider strategies like dollar-cost averaging to mitigate the impact of market fluctuations. Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions, which can help reduce the impact of market swings.

Unexpected Expenses

Maintain an emergency fund with at least 6-12 months’ worth of living expenses to cover unexpected costs, such as home repairs or family emergencies. Having a financial cushion can provide peace of mind and prevent you from having to make difficult financial decisions during a stressful time.

Retirement Planning Mistakes to Avoid

While planning for retirement can be a complex undertaking, it’s essential to be aware of common mistakes that can derail your progress. Some of the most prevalent retirement planning pitfalls include:

Delaying Savings

Procrastinating on saving for retirement can significantly impact your ability to reach your net worth goals. The earlier you start, the more time your money has to grow through the power of compound interest.

Neglecting Diversification

Concentrating your investments in a single asset or industry can expose your portfolio to unnecessary risk. Diversifying your investments can help mitigate the impact of market volatility and unexpected events.

Failing to Adjust for Inflation

Inflation can erode the purchasing power of your retirement savings over time. It’s crucial to factor in the effects of inflation when planning your long-term financial strategy.

Overlooking Healthcare Costs

As mentioned earlier, healthcare expenses can be a significant burden in retirement. Failing to properly account for these costs can quickly deplete your savings.

Exploring Early Retirement

While the focus of this guide has been on retiring comfortably at 60, some young adults may aspire to achieve early retirement, even before the traditional retirement age. Reaching this goal requires an even higher level of net worth and strategic financial planning.

To pursue early retirement, you’ll need to ensure that your net worth can not only cover your living expenses but also provide a sustainable income stream to last throughout your extended retirement. This may involve a more aggressive savings and investment strategy, as well as careful consideration of factors like healthcare coverage and potential part-time work.

If early retirement is your ultimate goal, it’s crucial to work closely with a financial advisor to develop a personalized plan that addresses the unique challenges and requirements of this path. With dedication and disciplined financial management, early retirement can be a realistic and attainable dream.

FAQ

What if I can’t retire at 60?

If retiring at 60 is not feasible, you may need to work longer, delay your retirement, or adjust your income needs and lifestyle expectations. Consult with a financial advisor to explore your options and create a revised retirement strategy that aligns with your new timeline and circumstances.

How can I catch up on my retirement savings if I’m behind?

If you’re behind on your retirement savings, consider working part-time or taking on a side hustle to earn additional income. You can also look for opportunities to reduce your expenses and redirect those funds towards your retirement goals. Additionally, seek the guidance of a financial advisor to develop a personalized plan for accelerating your savings.

Conclusion

Planning for a comfortable retirement at 60 requires a deep understanding of your net worth and its role in achieving your financial goals. By estimating your retirement income needs, exploring diverse income sources, and implementing strategic savings and investment strategies, you can position yourself for a fulfilling retirement.

Remember, flexibility and adaptability are key as you navigate the journey towards your retirement dreams. Stay proactive in managing your finances, and regularly review your progress to ensure you’re on track to meet your retirement aspirations. With dedication and informed decision-making, a fulfilling retirement at 60 can be within your reach.