The allure of early retirement, particularly at age 50, is undeniable. However, the reality is that only about 25% of Americans feel financially secure enough to retire before the traditional age of 65. This article explores the complex factors involved in making this decision, helping you determine if should I retire at 50 is a realistic and fulfilling path for you.

Should I Retire at 50? Evaluating Your Options

Deciding whether you should retire at 50 is a multifaceted choice influenced by various personal and financial factors. Understanding your unique circumstances and goals is crucial in making this significant life decision.

Financial Readiness

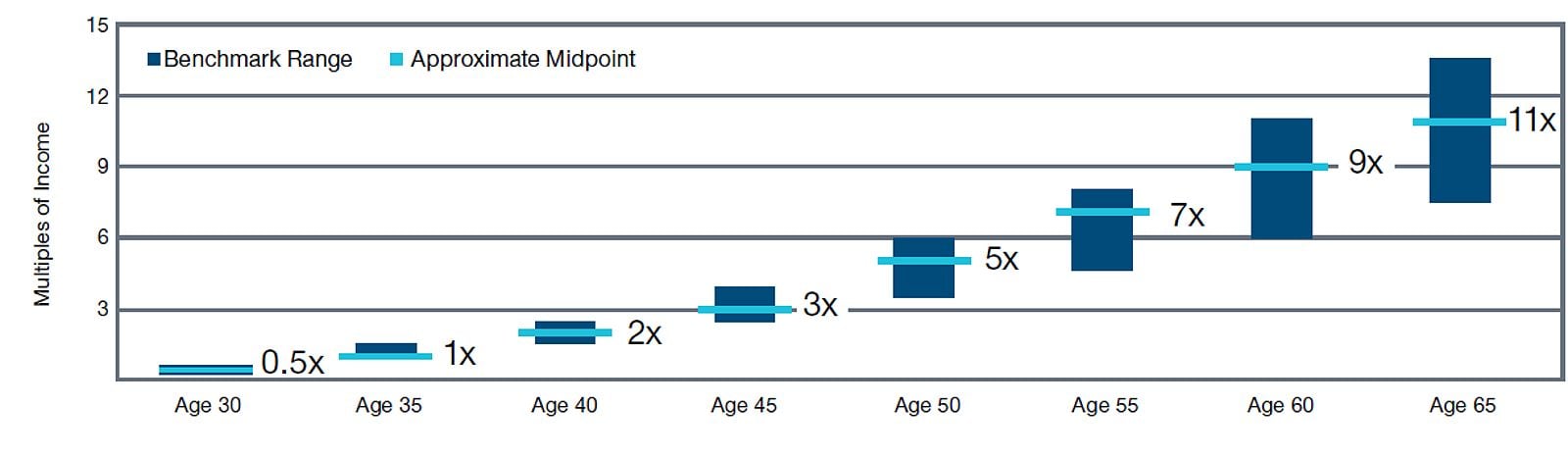

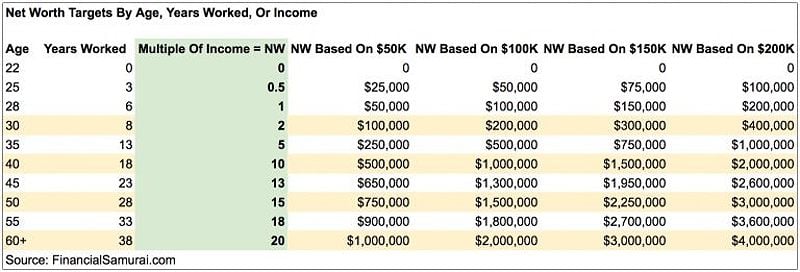

A robust financial foundation is essential when contemplating early retirement. Start by assessing your savings, investments, and potential income sources. Financial experts generally recommend that your net worth be at least 15 to 20 times your annual expenses. For instance, if you expect to spend $50,000 a year, aim for a net worth of approximately $750,000 to $1 million.

Additionally, consider how Social Security benefits and pension plans will contribute to your income. If you retire at 50, you may face complexities in accessing these benefits, as they can be substantially reduced if claimed before the full retirement age.

Lifestyle Considerations

Retiring at 50 can lead to significant lifestyle changes. It’s vital to have a clear vision of how you plan to spend your time. Will you travel, pursue hobbies, or engage in volunteer work? Many individuals find joy and fulfillment in activities outside traditional employment, but this requires careful planning to ensure these pursuits are sustainable.

Consider the impact of retirement on your social life as well. Leaving the workforce can lead to feelings of isolation if you don’t have a strategy to maintain social connections. Engaging in community activities, joining clubs, or even working part-time can help you stay connected and active.

Health and Well-being

Your health should be a pivotal consideration in your decision-making process. Early retirement can provide an opportunity to focus on wellness and reduce stress, potentially leading to a healthier lifestyle. However, it’s crucial to plan for healthcare costs that may arise as you age. Having adequate health insurance and understanding potential medical expenses is vital to avoid financial strain later.

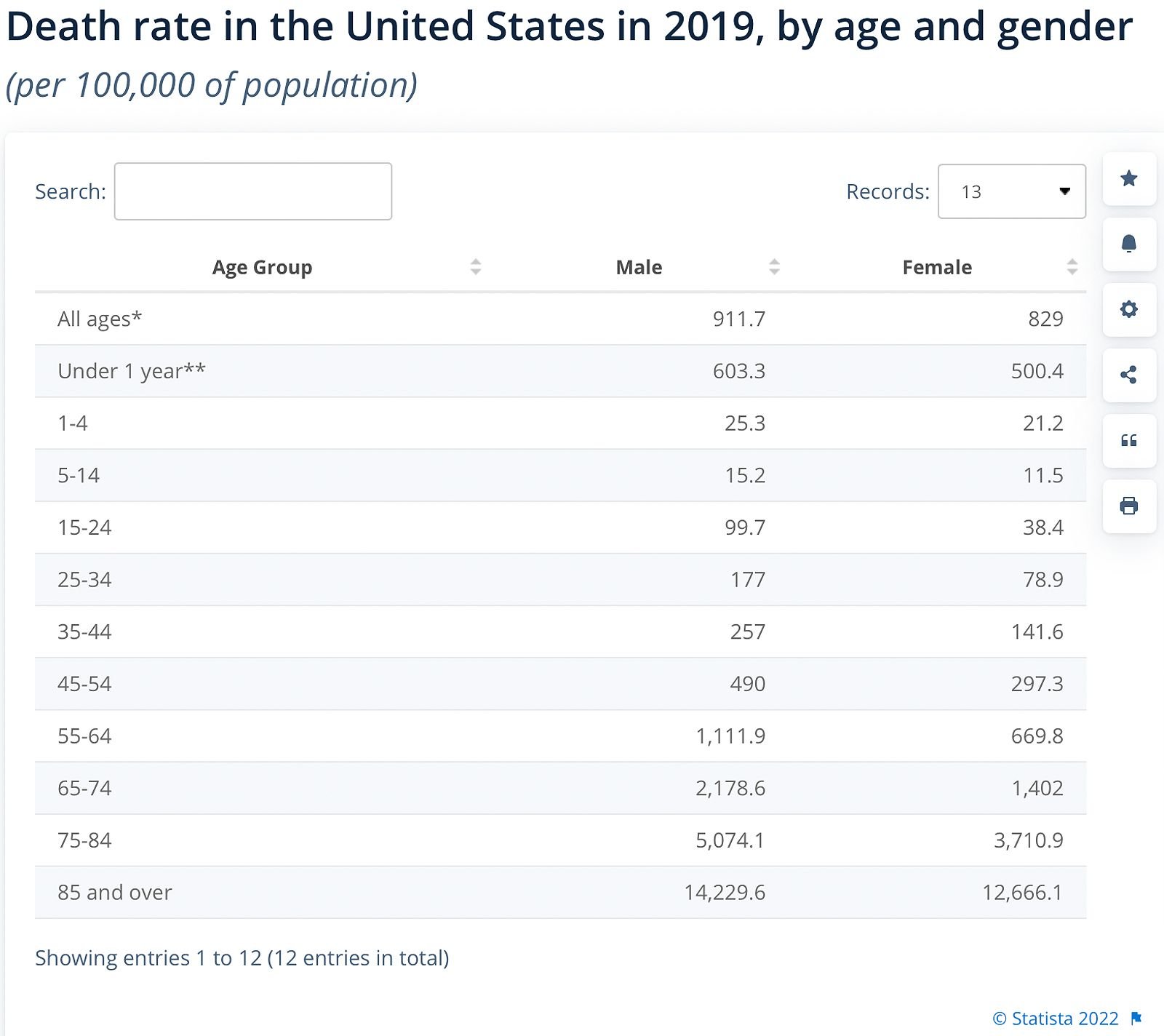

Statistics show that life expectancy is on the rise, with many individuals living into their 80s or beyond. If you retire at 50, you may need to plan for a retirement lasting 30 years or more, making it essential to factor these considerations into your financial planning.

Personal Factors

Personal aspirations and values play a significant role in the decision to retire early. Family obligations, career aspirations, and individual interests can all influence your choice. Take time to reflect on what you truly want from your retirement years.

Consider how your personal goals align with your financial readiness. For example, if you have a passion for travel or starting a new business, these aspirations should be part of your retirement planning.

Building a Solid Financial Foundation for Early Retirement

To retire at 50 successfully, establishing a strong financial foundation is paramount. This involves maximizing savings, generating passive income, and managing expenses effectively.

Maximizing Savings and Investments

Increasing your savings rate is one of the most effective strategies for early retirement. Aim to save at least 15-20% of your income annually and take full advantage of tax-advantaged retirement accounts, such as 401(k)s and IRAs. Investing wisely in a diversified portfolio can significantly enhance your retirement savings over time.

Consider incorporating real estate investments into your strategy. Rental properties can provide both income and appreciation, helping to offset living expenses during retirement.

Generating Passive Income Streams

Building passive income is crucial for those considering early retirement. This could include rental income, dividends from stocks, or income from a side business. Many individuals have successfully transitioned to retirement by establishing various income streams that allow them to maintain their desired lifestyle without solely relying on savings.

Explore opportunities that align with your interests and skills. Whether investing in real estate, starting an online business, or creating a blog, the possibilities for generating passive income are vast and can significantly enhance your financial security.

Managing Expenses and Debt

To enhance your financial readiness, focus on managing your expenses and reducing debt. Create a detailed budget to track your spending and identify areas where you can cut back. Paying down high-interest debt before retiring can significantly ease financial pressures.

Consider downsizing your home or relocating to a more affordable area. These changes can free up additional resources that can be directed toward your retirement savings.

Navigating the Transition to Early Retirement

Transitioning into retirement is not just a financial shift; it also involves significant lifestyle adjustments. Preparing for these changes can help ensure a smooth transition.

Finding Purpose and Meaning

Retirement should not be viewed as a time of idleness but rather as an opportunity to pursue passions and interests. Identifying activities that bring you joy and fulfillment can help mitigate feelings of boredom or loss of purpose. Many retirees find satisfaction in volunteering, mentoring, or engaging in hobbies that were previously sidelined due to work commitments.

Consider creating a list of activities you want to pursue in retirement. This can serve as a guide to help you stay engaged and fulfilled during this new chapter of your life.

Maintaining Social Connections

Social connections are vital for a fulfilling retirement. Without a structured work environment, it can be easy to feel isolated. Make a conscious effort to maintain relationships and create new connections. Join clubs, attend community events, or participate in local classes to meet new people and engage with your community.

Finding a balance between solitude and social engagement is crucial for mental well-being in retirement. Plan regular activities with friends and family to ensure you remain connected.

Adjusting to a New Lifestyle

Adapting to a new routine is essential for a successful retirement. This includes managing your time effectively and finding a balance between leisure and productive activities. Many retirees find joy in creating a schedule that includes both relaxation and structured activities.

Consider setting goals for your retirement, whether they involve travel, learning new skills, or pursuing health and fitness objectives. Having a plan can help you stay motivated and engaged.

Case Studies and Real-Life Examples

Examining the experiences of those who have successfully retired at 50 can provide valuable insights. Many individuals have achieved their retirement goals through strategic planning and a clear vision for their post-work life.

For instance, one retiree transitioned from a corporate job to a full-time travel blogger. By leveraging their savings and creating a passive income stream through their blog, they now enjoy a fulfilling lifestyle that aligns with their passions.

Another example is a couple who invested in rental properties, allowing them to generate consistent income while enjoying their newfound freedom. They emphasize that having a clear financial plan and a strong understanding of their expenses enabled them to retire comfortably.

These examples illustrate that with careful planning and a willingness to adapt, retiring at 50 can lead to a fulfilling and financially secure lifestyle.

Tips and Actionable Steps

If you are considering retiring at 50, here are some practical tips and actionable steps to help you prepare:

-

Assess Your Financial Readiness: Take stock of your savings, investments, and income sources. Create a detailed budget to understand your financial situation better.

-

Explore Passive Income Opportunities: Identify potential passive income streams that align with your skills and interests. This could include real estate investments, online businesses, or freelance work.

-

Create a Lifestyle Plan: Outline how you want to spend your retirement years. Consider hobbies, travel, volunteer work, and social activities to maintain engagement and fulfillment.

-

Seek Professional Guidance: Consult with a financial advisor or retirement coach to help you create a personalized retirement plan that aligns with your goals.

-

Stay Flexible: Be prepared to adjust your plans as needed. Life circumstances can change, and having a flexible mindset will help you navigate unexpected challenges.

FAQ

How much money do I need to retire at 50?

The amount needed varies greatly depending on individual expenses, lifestyle, and investment returns. Generally, aim for a net worth that is 15 to 20 times your annual expenses.

What if I don’t have enough saved for retirement at 50?

If you find yourself short on savings, consider increasing your savings rate, exploring additional income streams, or adjusting your retirement timeline.

What are the potential downsides of retiring at 50?

Some downsides include reduced Social Security benefits, the risk of outliving your savings, and the potential for feelings of boredom or lack of purpose.

Conclusion

Deciding whether you should retire at 50 requires a comprehensive evaluation of your financial situation, lifestyle goals, and personal aspirations. While retiring early can provide numerous benefits, such as increased leisure time and reduced stress, it is essential to ensure you have a solid financial foundation and a plan for your post-retirement life. By taking the time to assess your readiness and making informed decisions, you can create a fulfilling and financially secure retirement that aligns with your unique circumstances.