As a first-time homebuyer, the prospect of securing an affordable mortgage can be daunting. But did you know that a 5/1 adjustable-rate mortgage (ARM) could be a viable option? This type of mortgage offers the allure of lower initial interest rates, which can translate to more manageable monthly payments during the first five years. However, understanding the intricacies of a 5/1 ARM is crucial to making an informed decision.

Understanding the 5/1 ARM

What is a 5/1 ARM?

A 5/1 ARM is a specific type of mortgage where the interest rate is fixed for the first five years. After this initial period, the interest rate adjusts annually for the remaining 25 years of the loan term. This structure provides borrowers with a stable payment schedule for the first five years, followed by potential fluctuations based on market conditions.

For instance, if you take out a $300,000 5/1 ARM with an initial interest rate of 3%, your monthly payments for the first five years would be calculated based on that 3% rate. After the initial five years, the interest rate will adjust annually, potentially leading to higher or lower monthly payments.

Index and Margin

The interest rate on a 5/1 ARM is determined by two key components: the index and the margin.

The index serves as a benchmark interest rate, such as the 1-Year Constant Maturity Treasury (CMT) rate, the Secured Overnight Financing Rate (SOFR), or the London Interbank Offered Rate (LIBOR). Lenders use this rate to determine the adjustable portion of your mortgage’s interest rate.

The margin is a fixed percentage added to the index by the lender. This percentage remains constant throughout the life of the loan. The margin is essentially the lender’s profit on the loan, and it can vary depending on factors like the borrower’s credit score, the loan amount, and the lender’s policies.

To calculate your new interest rate after the initial five-year period, the lender will take the current index value and add the margin. This combined figure determines the fully-indexed rate, which is used to calculate your monthly payments moving forward.

Caps

To protect borrowers from drastic interest rate fluctuations, 5/1 ARMs have several caps in place:

- Initial Cap: This cap limits how much the interest rate can adjust up or down during the first adjustment period.

- Periodic Cap: This cap limits the adjustments that can occur during subsequent adjustment periods.

- Lifetime Cap: This cap sets the maximum interest rate the loan can reach over its entire term.

Caps are crucial for borrowers because they limit how much the interest rate can increase, even if the index rate skyrockets. This protection helps prevent borrowers from being overwhelmed by sudden and drastic payment increases.

Adjustment Process

The interest rate on a 5/1 ARM typically adjusts once a year after the initial fixed-rate period ends. Lenders are required to send borrowers a notice at least 60 days before the interest rate adjustment. This notice must include the new interest rate, the effective date of the change, and how the new rate was calculated.

Pros and Cons of a 5/1 ARM

Choosing a 5/1 ARM can be a strategic decision for first-time homebuyers, but it’s essential to weigh the potential benefits and risks.

Advantages of a 5/1 ARM

-

Lower Initial Interest Rate: One of the primary attractions of a 5/1 ARM is its lower initial interest rate compared to a traditional 30-year fixed-rate mortgage. This can result in significantly lower monthly payments during the first five years, making it more affordable for first-time buyers.

-

Potential for Long-Term Savings: If interest rates remain stable or decline after the initial fixed-rate period, a 5/1 ARM could cost less over the life of the loan than a fixed-rate mortgage. However, it’s important to remember that this potential for savings is contingent on interest rates remaining stable or declining after the initial fixed-rate period. If rates rise significantly, the 5/1 ARM could end up costing more than a fixed-rate mortgage.

-

Flexibility for Short-Term Homeowners: For those planning to stay in their home for only a few years, a 5/1 ARM can be advantageous. Homeowners may sell or refinance before the interest rate adjustments begin, allowing them to benefit from lower payments without facing the risks associated with future increases.

Disadvantages of a 5/1 ARM

-

Risk of Higher Interest Rates: The primary downside of a 5/1 ARM is the uncertainty regarding the interest rate after the first five years. If market rates rise significantly, your monthly payments could increase dramatically, potentially making the mortgage unaffordable.

-

Unpredictable Payments: After the initial five-year period, monthly mortgage payments become less predictable. This unpredictability can create financial anxiety and make it difficult to budget effectively.

-

Potential for Unaffordable Payments: In a scenario where interest rates skyrocket, your adjusted mortgage payment could become unmanageable. This situation may lead to financial stress or even the risk of defaulting on the loan.

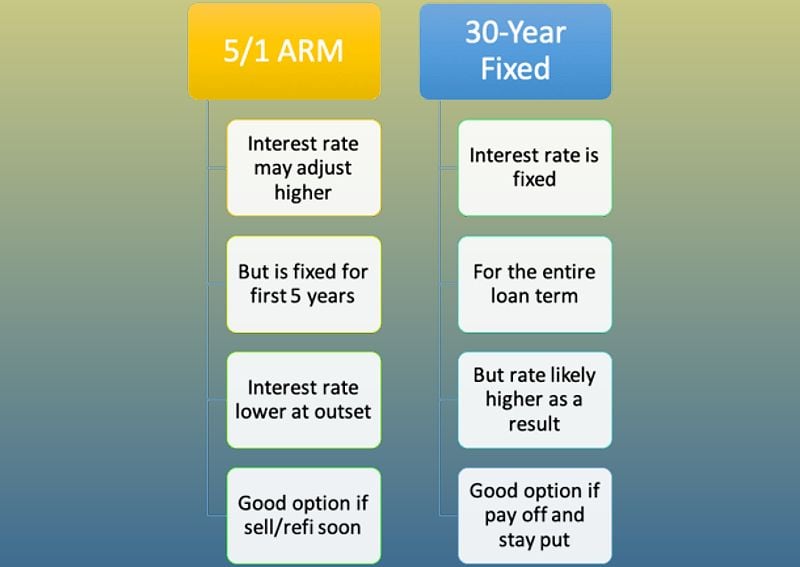

5/1 ARM vs- 30-Year Fixed-Rate Mortgage

When evaluating mortgage options, it’s essential to compare a 5/1 ARM with a traditional 30-year fixed-rate mortgage. Here’s a breakdown of the key differences:

| Feature | 5/1 ARM | 30-Year Fixed | Typical Interest Rate |

|---|---|---|---|

| Initial Interest Rate | Typically lower than 30-year fixed | Generally higher than a 5/1 ARM | 3.5% – 4.5% |

| Interest Rate Stability | Fixed for 5 years, then adjusts annually | Fixed for the entire 30-year term | 4.5% – 5.5% |

| Payment Predictability | Uncertain after initial 5-year period | Predictable for the life of the loan | N/A |

| Risk of Higher Payments | Exists after the initial 5-year period | No risk of increased payments | N/A |

| Potential for Savings | Possible if rates remain low or decline | Less opportunity for savings compared to ARM | N/A |

These are just estimates, and interest rates can vary depending on market conditions and individual borrower factors. It’s important to get quotes from multiple lenders to compare rates and terms.

When to Choose Each Option

5/1 ARM: Consider a 5/1 ARM if you:

- Plan to sell or refinance before the initial 5-year fixed-rate period ends.

- Have a lower budget and can benefit from the lower initial interest rate.

- Are comfortable with the uncertainty of future interest rate adjustments.

- Anticipate significant income growth in the future, as you could potentially afford higher payments later on.

30-Year Fixed-Rate Mortgage: Opt for a fixed-rate mortgage if you:

- Intend to stay in the home long-term.

- Value the stability and predictability of a fixed monthly payment.

- Prefer to avoid the risks associated with potential future payment increases.

- Prioritize financial stability and want to ensure your payments remain the same throughout the life of the loan.

Tips for First-Time Homebuyers Considering a 5/1 ARM

Navigating the complexities of a 5/1 ARM requires careful consideration. Here are some practical tips for first-time homebuyers:

-

Understand Your Financial Situation: Assess your budget thoroughly and determine your capacity to handle potential payment increases after the initial fixed-rate period. Ensure you can afford the maximum possible payment.

-

Consider Your Homeownership Timeline: Reflect on how long you plan to stay in the home. If your timeframe is less than 5 years, a 5/1 ARM may be suitable. For longer stays, a fixed-rate mortgage could be a more secure choice.

-

Research Interest Rate Trends: Before deciding on a 5/1 ARM, research current and historical interest rate trends. This will give you a better understanding of the potential risks and rewards associated with this type of mortgage.

-

Calculate the Break-Even Point: Determine the point at which the total cost of the 5/1 ARM would equal the total cost of a fixed-rate mortgage. This will help you decide if the potential savings from a lower initial interest rate are worth the risk of higher payments later on.

-

Shop Around for the Best Deal: Compare interest rates, fees, and terms from multiple lenders to find the most suitable 5/1 ARM for your financial situation.

-

Get Pre-Approved: Undergo the pre-approval process to understand your borrowing capacity and ensure you qualify for a mortgage.

-

Seek Professional Advice: Consult a mortgage broker or financial advisor for personalized guidance, helping you make an informed decision based on your unique circumstances.

FAQ

How often does the interest rate on a 5/1 ARM adjust?

The interest rate on a 5/1 ARM typically adjusts once a year after the initial five-year fixed-rate period ends.

Can I refinance my 5/1 ARM to a fixed-rate mortgage?

Yes, you can refinance your 5/1 ARM to a fixed-rate mortgage, but you may incur closing costs. Some 5/1 ARMs may also have prepayment penalties, which can discourage borrowers from refinancing early.

What if I can’t afford the higher payments after the interest rate adjusts?

If you find yourself unable to afford the higher payments, you have options. Consider refinancing, selling your home, or discussing payment modification options with your lender. Payment modification options may include extending the loan term, reducing the principal amount, or temporarily lowering the interest rate, but these options may come with additional fees or interest rate adjustments.

Is a 5/1 ARM right for everyone?

No, a 5/1 ARM is not suitable for every first-time homebuyer. It is best for those who plan to sell or refinance before the interest rate adjusts or who are comfortable with the risk of higher payments in the future.

Conclusion

Navigating the world of mortgages can be a daunting task for first-time homebuyers, but understanding the complexities of a 5/1 ARM can be a valuable step in the right direction. While a 5/1 ARM offers the allure of lower initial interest rates and the potential for long-term savings, it’s crucial to carefully consider the risks associated with future interest rate adjustments and unpredictable payments.

Ultimately, the decision of whether a 5/1 ARM is right for you depends on your individual circumstances and financial goals. Take the time to understand the intricacies of this type of mortgage, research interest rate trends, and consult with a mortgage professional to make an informed decision. With careful planning and the right mortgage solution, you can embark on your homeownership journey with confidence and financial security.