Retirement is a significant milestone, and helping clients find the right age to retire is a crucial part of your role as a financial advisor. This article provides a comprehensive guide to help you understand the factors that influence retirement decisions and equip you with the tools and insights to guide your clients toward a fulfilling and financially secure retirement.

Financial Security: The Foundation of a Successful Retirement

Assessing Financial Readiness

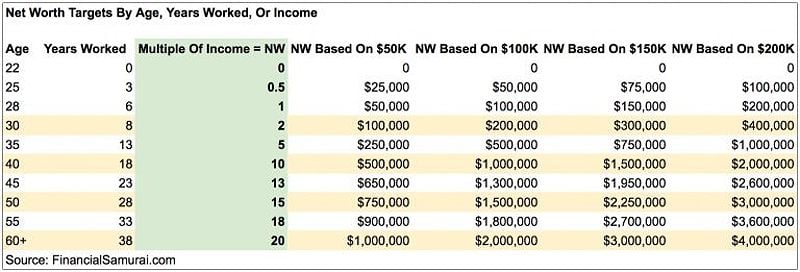

When determining the ideal retirement age, a thorough assessment of financial readiness is crucial. While the commonly cited 25x rule of thumb for retirement savings is a good starting point, it’s essential to consider each client’s unique circumstances, including their location, healthcare costs, and desired lifestyle. Encourage your clients to use retirement calculators to estimate their specific needs and factor in potential inflation.

“It’s crucial to run personalized scenarios to determine a realistic savings goal, taking into account your unique circumstances,” advises [financial advisor name].

Beyond the 25x rule, there are other important factors to consider when assessing financial readiness. Clients should evaluate their current debt levels, any outstanding loans or mortgages, and the potential impact on their retirement income. Additionally, it’s wise to have a plan for managing expenses in retirement, such as healthcare, travel, and hobbies.

Social Security Benefits: Timing is Key

The decision on when to start collecting Social Security benefits can significantly impact a client’s retirement income. Encourage your clients to explore the online tools offered by the Social Security Administration to estimate their benefits based on their work history and intended claiming age. Discuss the trade-offs between early claiming and delayed claiming, considering factors like health, longevity, and the need for additional income.

Remember, while delaying benefits can increase payouts, it also means forgoing those funds for longer, which could be a significant drawback for those with immediate financial needs. Clients should carefully weigh their options and consider their unique circumstances when determining the optimal Social Security claiming strategy.

Managing Expenses in Retirement

Budgeting and managing expenses in retirement is essential for long-term financial stability. Discuss strategies with your clients to identify potential cost-saving opportunities, such as downsizing, reducing travel expenses, and maximizing healthcare benefits. Emphasize the importance of considering inflation and unexpected costs when planning their retirement budget.

It’s also crucial to help your clients understand the impact of taxes on their retirement income. Strategies like tax-efficient withdrawal planning and leveraging tax-advantaged accounts can make a significant difference in their long-term financial security.

Health and Well-being: A Crucial Factor in Retirement Planning

Assessing Health Status and Future Healthcare Needs

Encourage your clients to consider both their physical and mental health when planning for retirement. Discuss the complexities of health insurance options for retirees, including Medicare, supplemental insurance, and long-term care plans. Highlight the importance of preventative care and regular checkups in retirement.

“Staying active physically and mentally is vital for a healthy retirement,” says [health professional name]. “Engage in activities you enjoy, whether it’s gardening, hiking, or learning a new skill.”

Clients should also consider the potential impact of healthcare costs on their retirement savings. Unexpected medical expenses can quickly deplete retirement funds, so it’s crucial to plan for these contingencies. Encourage your clients to research and understand the coverage provided by their healthcare plans, as well as any potential gaps or limitations.

Retirement Lifestyle and Activities

Retirement is not just about financial security; it’s also about maintaining a fulfilling and active lifestyle. Discuss with your clients their desired retirement activities, hobbies, and social connections. Explore strategies to help them combat boredom and maintain a sense of purpose, such as joining clubs, volunteering, or pursuing new interests.

Staying socially engaged is particularly important for retirees, as it can help combat feelings of isolation and loneliness. Encourage your clients to explore opportunities to connect with their community, whether through volunteer work, hobby groups, or simply maintaining strong relationships with family and friends.

Personal Goals and Aspirations: Beyond Financial Security

Defining Retirement Vision

Encourage your clients to visualize their ideal retirement and make plans to achieve it. Whether they dream of traveling the world, pursuing personal growth, or simply enjoying more free time, aligning their retirement goals with their values and aspirations is crucial.

Discussing your clients’ retirement vision can also reveal unique opportunities or challenges that may not be apparent from a purely financial perspective. For example, a client who wants to spend more time with grandchildren may need to factor in the cost of travel or consider relocating closer to family.

Balancing Goals with Financial Reality

Remind your clients that retirement is an ongoing process, not a one-time event. Emphasize the importance of flexibility and adaptability in their retirement planning, as their needs and circumstances may change over time. Consider part-time work or consulting opportunities to supplement income and maintain a sense of purpose.

“Retirement is not a one-time event, but an ongoing process,” says [financial planner name]. “Be prepared to adjust your plans as your needs and circumstances change.”

Striking the right balance between personal goals and financial reality is essential for a successful retirement. Encourage your clients to remain open-minded and willing to compromise as they navigate this new chapter of their lives.

Debunking Common Myths about Whats a Good Age to Retire

Myth 1: You Should Retire as Soon as You Can

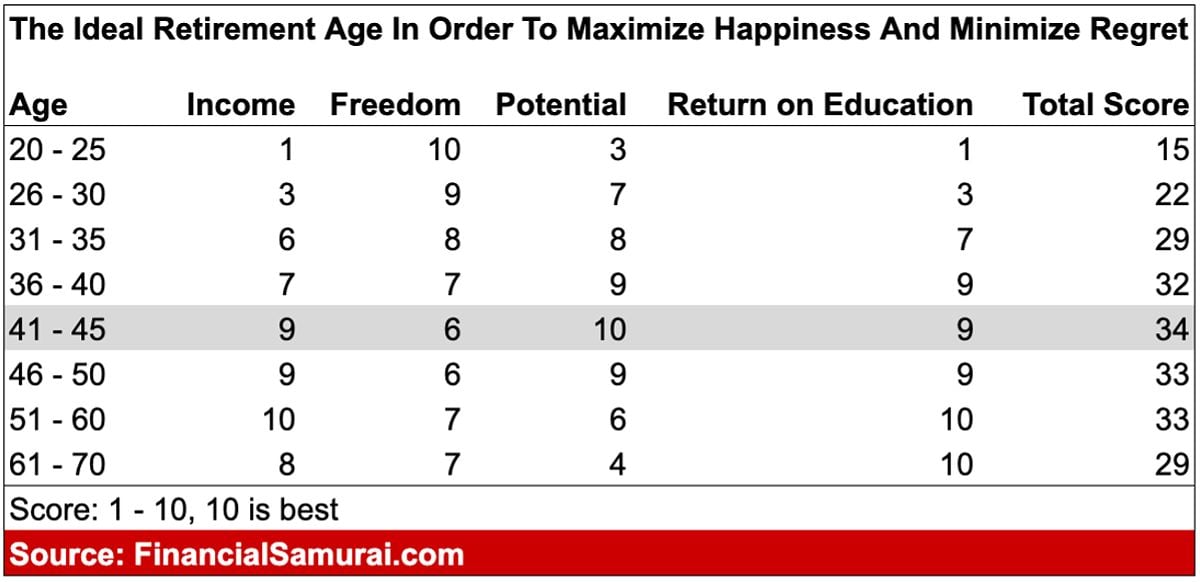

While early retirement can be appealing, it’s important for your clients to consider the long-term financial implications. Retiring too early could lead to financial strain and a need to return to work. Discuss the potential impact on Social Security benefits and the importance of maintaining a sense of purpose and social connection.

It’s also worth exploring the potential benefits of continued work, even in a part-time or consulting capacity. Staying engaged in the workforce can provide additional income, opportunities for professional growth, and a sense of purpose.

Myth 2: You Need to be 65 to Retire

The traditional retirement age of 65 is becoming outdated. Encourage your clients to consider factors like health, financial readiness, and job satisfaction when determining their retirement age. Highlight the trend towards “encore careers,” where many retirees find new and fulfilling work opportunities in their later years.

Emphasize that there is no one-size-fits-all retirement age. The ideal age will vary based on each client’s unique circumstances and goals. Some may choose to retire earlier, while others may find fulfillment in working longer.

Myth 3: Retirement is the End of Your Life

Reframe retirement as a time for new beginnings and personal growth. Discuss the opportunities for your clients to redefine their identity, give back to the community, and pursue passions they may have put on hold during their working years. Emphasize the importance of staying active and engaged through hobbies, social groups, and travel.

Retirement can be a time of great personal and professional exploration. Encourage your clients to embrace the freedom and flexibility that retirement offers, and to view it as an opportunity to pursue their dreams and create a fulfilling new chapter of their lives.

Strategies for Achieving a Successful Retirement

Saving and Investing

Encourage your clients to explore tax-advantaged retirement accounts, such as Roth IRAs, and take full advantage of any employer-sponsored retirement plans with matching contributions. Emphasize the importance of diversifying their investment portfolios across different asset classes to mitigate risk.

It’s also essential to review and adjust investment strategies as clients approach retirement. Shifting towards more conservative investments can help protect their assets and ensure a stable income stream in their later years.

Building Passive Income Streams

Explore passive income opportunities with your clients, such as real estate investments, dividend-paying stocks, or online business ventures. Advise them to consider creating these income streams while still working to provide a financial cushion for their retirement years.

Passive income can be a powerful tool in retirement, as it can supplement clients’ savings and reduce their reliance on drawing down their nest egg. Encourage your clients to research and evaluate various passive income options that align with their risk tolerance and long-term goals.

Managing Finances in Retirement

Suggest using budgeting tools and apps to help your clients track their spending and manage their finances in retirement. Encourage them to seek professional financial advice to create a personalized retirement plan and manage their investments effectively. Explore options for downsizing or reducing expenses to stretch their savings.

Proper financial management in retirement is essential to ensure the longevity of your clients’ savings. Educate them on tax-efficient withdrawal strategies, required minimum distributions, and other important financial considerations to help them maintain their desired lifestyle.

Staying Active and Engaged

Discuss the importance of maintaining an active and engaged lifestyle in retirement. Encourage your clients to consider volunteering, joining community groups, or pursuing new hobbies and interests to keep their minds and bodies active, as well as maintain social connections.

Remaining socially and mentally engaged can have a significant positive impact on your clients’ well-being in retirement. Suggest specific activities or organizations that may be of interest, and help them create a plan to stay actively involved in their communities.

The Bottom Line: Finding Your Ideal Retirement Age

Retirement planning is a personalized journey, and collaborating with a financial advisor can help your clients make informed decisions about their retirement age. Remind them to be prepared to adapt their plans as their circumstances change, and embrace the opportunities that retirement offers, such as travel, hobbies, and personal growth.

By taking a comprehensive, client-centered approach to retirement planning, you can help your clients achieve a fulfilling and financially secure retirement. Stay up-to-date on the latest trends and best practices, and be ready to guide your clients through this exciting new chapter of their lives.

FAQ

Q: How can I make my retirement savings last longer?

A: Consider strategies like downsizing your home, relocating to a lower cost-of-living area, and carefully managing your investment portfolio to optimize your retirement income. Exploring opportunities for part-time work or consulting can also help supplement your savings and extend their longevity.

Q: What are some common retirement scams to be aware of?

A: Be wary of unsolicited offers for investment schemes, fraudulent annuities, and high-pressure sales tactics. Encourage your clients to thoroughly research any financial products or services before making a decision, and to consult with you or other trusted professionals to ensure they are making informed choices.

Q: What are the latest trends in retirement planning?

A: Trends include the rise of early retirement, the growing popularity of passive income streams, and an increased focus on health and well-being in retirement. Staying informed on these evolving trends can help you provide the best guidance to your clients and ensure they are prepared for the future.

Conclusion

By understanding the various factors that influence retirement decisions and providing personalized guidance, you can empower your clients to make informed choices about their retirement and achieve a fulfilling and financially secure future. Remember, retirement planning is a dynamic process, and flexibility, adaptability, and a client-focused approach are key to their success.